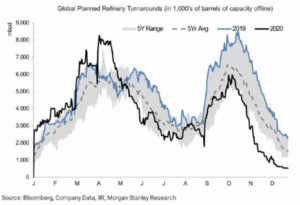

Refiners Projected to Have Higher than Normal Spring Turnarounds

Analysts expect planned global refinery turnarounds to average 4.6 million barrels per day in 1Q 2020 — 34% above normal.

Global Planned Refinery Turnarounds (in 1,000’s of barrels of capacity offline)

What Does This Mean for Gasoline Retail Marketers?

Retail gasoline marketers have a seasonal problem. The robust profit margins they often enjoy in the late autumn and winter can deteriorate as spring arrives. This spring margin squeeze does not occur every year of course, but the pressure on profit margins between New Year’s Day and Memorial Day can be severe.

Wholesale gasoline inventories usually peak in the last few weeks of February. Refineries perform maintenance, also known as turnaround, during late winter/ early spring. Spring turnaround reduces refining capacity just when the market begins to anticipate an increase in gasoline demand due to the summer driving season.

This causes gasoline prices at the terminal to move higher. When this happens, retailers’ street margins get squeezed.

What can you do about it?

The gasoline retailer can establish hedge positions to offset this expected margin squeeze. POWERHOUSE works with clients across the country to develop customized strategies to protect margins.

Each company operates in unique conditions so call us to discuss how we can help your business protect your margins and grow your business.

David Thompson, CMT Executive Vice President

3214 O Street, NW #2

Washington, DC 20007

Phone : (202) 333-5380

Fax: (202) 280-1383

E-mail: david@powerhousetl.com

Futures trading involves significant risk and is not suitable for everyone. Transactions in securities futures, commodity and index futures and options on future markets carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Past performance may not be indicative of future results. This is not an offer to invest in any investment program.