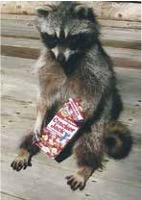

Raccoons and Receivables

I have an 8-year-old son. Almost every morning he wakes up extra early and tiptoes into the pantry to grab a “snack.” These snacks typically include whatever he can reach (or climb to get), and he tears into them with no regard for what he does to the packaging. I joke that it looks like a raccoon invaded our home each morning. While I worked through repairing a tattered box of cereal, it reminded me of what credit insurance carriers did with coverage in 2020. They gobbled it all up and took it away from our customers.

If you looked at credit insurance in 2020, odds are that coverage simply wasn’t good enough to justify purchasing. Or you had a policy and the carrier took some of your coverage away, driving frustration. Fuel companies wanted to insure a certain receivable, but the carrier was unwilling to cover. Yes, credit insurance losses were high for the carriers, and they needed to limit their exposure. One in particular had over 5,000 claims last year but surprisingly, this was under what they originally forecasted at the beginning of the pandemic. Maybe they jumped the gun a bit and surprisingly, the world didn’t end. This is great news, as credit insurers are starting to be more flexible and coverage is now more available. As these credit insurers “repair the cereal box” and start getting more aggressive with coverage, now is a perfect time to re-look at credit insurance. Capacity for coverage is becoming more available, and rates are declining. Whether you go with one or multiple carriers, contact us to help you find that coverage or shop your current policy to make sure you’re competitive with your peers.

If you’re not familiar with credit insurance, it is a policy that guarantees your receivables. Simply put, if you sell product to a company and they don’t pay, you file a claim and the insurer pays you. Businesses don’t think twice when insuring their trucks, buildings and equipment, but their A/R can make up to 40% of their assets and is most commonly uninsured. You’re more likely to file a claim on your receivables than the fire insurance for your building. For a fraction of a penny per gallon, it makes too much sense to not explore how credit insurance can help your company. This is a safe solution to help you aggressively sell to new customers and increase the credit limit of your existing. Better yet, there is no fee to work with us.