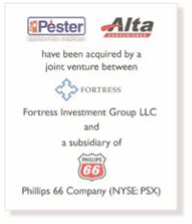

Case Study: Matrix Announces the Successful Sale of Pester Marketing Company d/b/a Alta Convenience

Situation:

- Headquartered in Denver, Colorado, Pester Marketing Company (“Pester” or the “Company”) is one of the largest operators of convenience stores in the Front Range corridor with stores that span Colorado, Kansas, New Mexico, and Following a series of acquisitions, Pester more than doubled its store count to 106 locations in less than three years.

- Pester was first acquired by the current shareholder group in May of 2016 as a spin-off from World Fuel Services Corporation (NYSE: INT) when its founder, Jack Pester, decided to exit the industry. As the ownership group contemplated exiting the investment, Matrix was contacted to discuss strategic planning and provide valuation services. Ultimately, the shareholders decided it was an opportune time to take Pester to market.

Objective:

- Our objective was to customize, execute, and complete a confidential sale process that would allow the Company’s shareholders to realize maximum after-tax value upon the sale of Pester or its assets and to minimize post- closing liabilities to the seller by way of representation and warranty insurance, as well as pollution legal liability insurance.

Solution:

- Matrix provided merger and acquisition advisory services to Pester, which included valuation advisory, marketing of the business through a confidential, structured sale process, and negotiation of the transaction. Multiple competitive offers were received, and CF H33 LLC, a new joint venture between Fortress Investment Group LLC, a leading global investment manager, and a subsidiary of Phillips 66 Company (NYSE: PSX), was ultimately selected as the acquirer. Matrix assisted in the negotiation of the asset purchase agreement and coordinated the due diligence and closing process and the transaction closed in January 2021.

About Matrix’s Downstream Energy & Convenience Retail Investment Banking Group:

Matrix’s Downstream Energy & Convenience Retail Investment Banking Group is recognized as the national leader in providing transactional advisory services to companies in the downstream energy and multi-site retail sectors including convenience retailing, petroleum marketing & distribution, propane distribution, heating oil distribution, lubricants distribution, petroleum logistics, terminals and car washes. Group members are dedicated to these sectors and draw upon complementary experiences to provide advisory services to complete sophisticated merger and acquisition transactions, debt and equity capital raises, corporate valuations, special situations and strategic planning engagements. Since its inception in 1997, this dedicated group has successfully completed over 250 engagements in these sectors with a total transaction value of more than $12 billion.

For more information,

contact Spencer P. Cavalier, CFA, ASA

at spcavalier@matrixcmg.com

or 667.217.3320