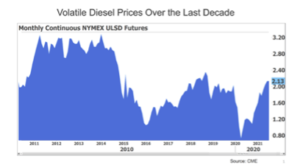

Volatility Isn’t New to the Fuel Markets

To paraphrase from the software industry: volatility is a feature, not a bug. But it often bugs fuel marketers and their customers. It doesn’t have to.

The fuel buyer’s problem:

If they delay buying and the price goes even higher, they are hurt financially. If they buy now and price collapses, they have buyer’s remorse.

Innovative fuel marketers can use options strategies to offer solutions. For example,

- A call option is the right to buy a particular futures contract at a certain strike price.

- However, when prices move down, you are not obligated to buy the futures at the strike price.

- Call option buyers have protection in that their risk is limited to the premium they must pay for the call option. They can lock in the strike price and profit (should the underlying futures contract rise enough) while risking only the upfront premium paid.

A call option is an effective way to address the problem of fuel buyer’s remorse. The customer has upside price protection but can still benefit if prices mover lower.

Set yourself apart from your competition. Call POWERHOUSE and learn new ways you can use this important tool.

For more information,

contact David Thompson

at david@powerhousetl.com

or (202) 333-5380