Property Casualty Market Report

Summer 2022

Holmes Murphy continuously monitors the insurance market to keep a pulse of rates, capacity, underwriting appetite changes, financial stability of insurance carriers, and service capabilities to better prepare customers for changes that may impact their policies.

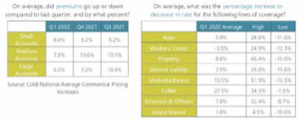

Q1 of 2022 was the 18th consecutive quarter of overall rate increases; however, they have tempered. The overall average rate increase was 6.6% compared to 8.7% from Q4 2021. All lines of coverage experienced increases in rate except Workers’ Compensation, which had a slight decrease of 0.5%. Small Accounts (premium less than $250k) saw relatively stable increases from 6.3 to 6.4% increase. Medium Accounts (premium between $250k and $1M) experienced average increases falling from 10.6% to 7.3%. Large Accounts (premium over $1M) also saw a drop last quarter in their average increases falling from 9.2% to 6.2%.

Regardless of business size, location, and insurance needs, market and environmental forces continue to drive insurance rates up. The insurance renewal process has been lengthy as insurance carriers are closely reviewing each account. Even on incumbent accounts, the underwriting process is focused on gathering all the details, updates, and understanding of the risks facing the organization in today’s risk environment.

Reference the Key Takeaways section of this document for additional information and recommendations to best manage and respond to these changes.

Benchmarking – Rate Comparison Data

The following charts compare the industry market results* in Q1 2022 ( January 1-March 31) compared to Q4 2021 (October 1-December 31).

Benchmarking – Historical Premium & Rate Changes

Source: CIAB National Average Commercial Pricing Increases

Key Takeaways

There are a lot of dynamic forces in the market today. Awareness of those items and understanding of how it may impact your insurance program will prepare you for the various buying decisions.

Umbrella pricing increases reflect the numerous nuclear verdicts in General and Auto Liability suits, along with the social inflation impacting claim settlements. Insurance carriers are cutting limits to minimize risk on the balance sheet.

Cyber policies continue to be challenging. Those rate increases are a result of the massive increase to frequency (number) and severity (dollars/cost) of attacks. Through the recent years, the industry has found focusing on the prevention of cyber claims can significantly decrease exposure to loss. In addition to increase rates to fund for potential claims, insurance carriers are requiring the adoption of security protocol, like multi-factor authentication.

Inflation: Increased cost of parts, increased cost of labor, and delays due to supply chain disruption are all causing increased claims payments. This inflation is requiring the increased insurance-to- value limits and driving cost of risk (rate) are putting pressure on loss ratios. In order for carriers to adequately price and reserve for the expected claim payout, they need to increase rate.

Weather: According to NOAA, “In 2021, the U.S. experienced 20 separate billion-dollar weather and climate disasters, putting 2021 in second place for the most disasters in a calendar year, behind the record 22 separate billion-dollar events in 2020.” And Hurricane Season has arrived, running from June 1 through November 30.

Here’s hoping for blue skies (some nourishing rain) and calm breeze in the months again!

Take a look at the full CIAB Commercial Property/Casualty Market Index Q1 2022 for a deeper dive into the marketplace trends.

*Holmes Murphy is an active member of The Council of Insurance Agents & Brokers’ (CIAB). CIAB, established in 1913 is a high-touch member-based trade association for over 200 of the world’s top commercial insurance and employee benefits brokerages. As an active member, Holmes Murphy utilizes the resources to stay in tune with insurance market conditions in our local community and across the country. Any advice, comments, direction, statements, or suggestions contained herein is provided for your information only and is not intended as, nor does it constitute, legal advice. Neither Holmes Murphy, or any of its subsidiaries or affiliates, represent or warrant, express or implied, that such statements are accurate or complete. Nothing contained herein shall be construed as or constitute a legal opinion. You have the right to, and should, seek the advice of legal counsel at your own expense.

Gerald Johnson

gjohnson@holmesmurphy.com

(515) 223-6826