Why higher gas prices & card fees can actually be a good thing

Operating as a fuel retailer can be one of the most difficult business ventures one can embark on. Unstable commodity prices, transportation difficulties, lack of a consistent work force, and ever-changing regulations are just a few of the hurdles retailers need to clear every day. As we weather the various storms that roll through the convenience and fuel retail industry, let’s shift some focus to a “silver lining” that is worth your attention.

The price at the pump has been skyrocketing throughout the first half of 2022, so much so that Visa and Mastercard have increased pump limits to help keep the convenience aspect of a C-store by not forcing the consumer to conduct multiple transactions for a single fill-up. As a retailer, this helps in keeping your customers happy and coming back to your store.

But what about those rising card fees you are noticing on your monthly statement? Are these rising prices costing you more and eating into your bottom line?

As the price at the pump rises, the overall fees you are paying are higher than you are probably accustomed to seeing on that monthly statement. However, your fees as a percentage of your sales should be trending lower as these prices trend higher. One of the most important metrics a retailer can focus on is Effective Rate (gross fees/gross sales), and one of the best ways to lower that Effective Rate is by increasing the average ticket price. This can be accomplished by implementing several different business tactics such as running promotions on high margin items; strategic placement of “impulse items;” and constantly changing the store merchandise layout.

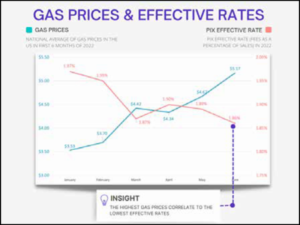

Now, back to the silver lining mentioned earlier. As the average price at the pump increases, the effective rate decreases. Let’s look at an example of how the national average gas price for the first half of 2022 correlates with the average Effective Rate experienced by PIX customers.

Over the last 6 months our customer base has seen a 10-basis point drop in fees in last 6 months. As you fight for profit with higher prices, your card processing fees can aid in winning back margin.

While that is an average, in many cases you can win back even more margin. For instance, the most common card presented at a convenience store is a debit card. The regulated debit card has an interchange fee of 0.05% + $0.22. In simple transaction terms, as your average car fill up has gone from $30 to $70 you’ve only seen an increase of $0.02 in debit fees.

Interested in finding more wins in a world of inflation? Let’s talk to see how your card fees have been impacting your profit margins.

Visit www.pixcardprocessing.com/btl to find out more

KC Cook

Founder & President

KC COOK | PIX

p: 919.215.7908

e: kc@trypix.io

w: pixcardprocessing.com