Consumers Care More About The Price On Your Sign Than The Color Of The Canopy

How much is one fuel brand costing you compared to others? 1 in 10 shoppers care about the fuel brand when it’s time to fill up. The other nine care most about the fuel price. (Also true: 0 in 10 shoppers care how much their Rewards Card costs you, the merchant.) We all know Major Fuel Brands saw record years because of fuel prices. But how did their card processing divisions fare in 2022?

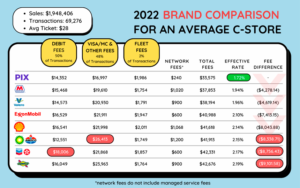

An emoji is worth a thousand words:

With the average sale increasing by 50% in recent months, this means more revenue for the processors. Let’s look at an example:

Example A: Lower Gas Prices, Sale Amount: $50

- REVENUE: One Fuel Brand charges Debit fees of 1.30% + $0.14; Total Revenue: $0.79

- COST: The Debit network fee charged by the bank are 05% + $0.22; Totaling: $0.25

- NET: Net Revenue for the Fuel Brand: $0.55

- MARGIN: 69%

Example B: Higher Gas Prices, Sale Amount: $100

- REVENUE: Same Fees Charged 30% + $0.14, Total Revenue: $1.44

- COST: 05% + $0.22, Total cost: $0.27

- NET: $1.17

- MARGIN: 81%

Not all Brands are created equal when it comes to card fees. Our chart is actual data from an average c-store from 2022. It’s plain to see that some brands discount certain cards over others.

3 CARD FEE TIPS WHEN CONSIDERING A BRAND CHANGE:

- ASK TO SEE A COMPARISON OF CARD FEES. If your store is pumping 100,000 GPM, the difference between the two brands could be more than $150,000 over a branded contract.

- IF CONSIDERING AN UNBRANDED / PRIVATE LABEL BRAND: NEVER AGREE TO A “BLENDED RATE” OR “FLAT RATE.” “1.90% + $0.15” looks great until you realize that some true bank fees are as low as 0.05%.

- When analyzing your current processor’s fees, use this simple rule to clear up the confusing fee structure: If your average ticket is around $25, your total fees should be at or under 00%.

As Fortune 500 layoffs flood our headlines, interest rates continue to rise, and carried credit card balances are at a 20-year high, 2023 consumers are looking for ways to pinch pennies. Consumers will likely care more about the price on your sign than the color of the canopy.

If you’re shopping brands and would like us to provide a detailed analysis of card fees between two brands, give us a shout!

KC Cook

Founder & President

KC COOK | PIX

p: 919.215.7908

e: kc@trypix.io

w: pixcardprocessing.com