Monitoring the Insurance Market

Winter 2022

Holmes Murphy continuously monitors the insurance market to keep a pulse of rates, capacity, underwriting appetite changes, financial stability of insurance carriers, and service capabilities to better prepare customers for changes that may impact their policies.

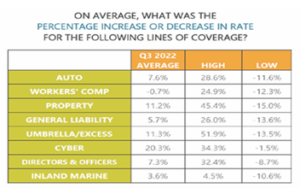

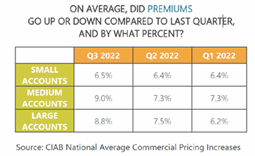

Q3 2022 was the 20th consecutive quarter of overall rate increases. The overall average rate increase was 8.1%, up from 7.1 in Q2. All lines of coverage continue to increase in rate except Workers’ Compensation which continued to decrease slightly at 0.7%. Small Accounts (premium less than $250k) went up slightly from Q2 to Q3 with an increase of 6.5% compared to 6.4%. Medium Accounts (premium between $250k and $1M) increased from Q2 at 7.3% to 9.0% in Q3. Large Accounts (premium over $1M) saw a slight increase from Q2 from 7.5% to 8.8%.

Reference the “Key Takeaways” section of this document for additional information and recommendations to best manage and respond to these changes.

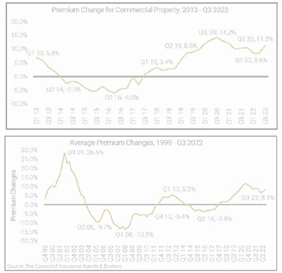

Benchmarking – Historical Premium & Rate Changes

Benchmarking – Historical Premium & Rate Changes

Source: CIAB National Average Commercial Pricing Increases

Key Takeaways

There are a lot of dynamic forces in the market today. Awareness of those items and understanding of how it may impact your insurance program will prepare you for the various buying decisions.

Cyber: Cyber risk increases appear to have peaked in Q1 2022 and the marketplace is stabilizing. Cyber is not a mature market yet and increases are still the norm, however the increases are more moderate than they were. Cyber capacity remains very strong and downward pressure exists. Underwriting discipline has increased and carriers are more willing to walk away from an opportunity than they were three years ago.

Executive Liability: After about 18 months of rising premiums, the private company Directors & Officers marketplace has stabilized, flattened and is experiencing some premium relief. Some carriers and clients are still experiencing increases based on growth or loss experience, but increases are fewer and flatter than they have been. Employment Practices Liability is largely stable with modest adjustments, although this line of business has softened considerably. Fiduciary Liability continues to experience restrictions for excessive fee cases but minimal pricing changes.

Property: Replacement cost trending and insurance-to-value continue to be a top priority for underwriters. Examining property values and increasing limits with inflation are more important than ever to both avoid underinsurance and demonstrate to underwriters that you are being thoughtful in your approach to developing your values. Natural disasters like Hurricane Ian, flooding in Kentucky and Tennessee, Midwest storms, and wildfires continue to put significant pressure on market capacity causing increased rates and deductibles and stricter terms and conditions. While the environment has improved in some sectors, placement continues to be a challenge for tougher classes of businesses like food manufacturing or apartments/senior living and for accounts with loss activity, risk quality issues, or catastrophe exposure, often requiring multi-carrier “shared and layered” solutions in lieu of 100% single-carrier placements.

Take a look at the full CIAB Q3 2022 Commercial Property/ Casualty Market Index for a deeper dive into the marketplace trends.

Gerald Johnson

gjohnson@holmesmurphy.com

(515) 223-6826