The Credit Card Competition Act Of 2023 Will Shake Up Our Industry.

By now, you’ve heard of the Credit Card Competition Act. It was reintroduced in the Senate this summer with more support after being initially shot down in 2022.

The premise is simple: Visa and Mastercard must allow alternative networks to process their cards, creating competition and potentially lowering Interchange fees.

Reducing interchange fees has raised concerns (and provided many hot takes) about how it would affect consumers and merchants. Credit card reward/points bloggers are against the move, saying it would mean the end of rewards. Mastercard has responded with a published letter that they won’t raise interchange fees this fall (mentioning this point half a dozen times to drive home the point.)

Hot takes aside, I’m more interested in how this would practically impact the Petroleum industry. Here are the good, the bad, and the unclear details of how the CCCA would impact our Industry:

The Good:

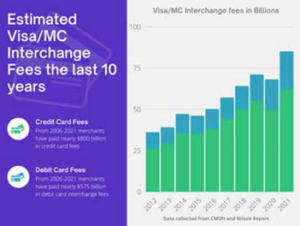

- Competition is good for lowering (See: Your price sign outside one of your gas stations.) Banks earn higher profit margins than most convenience stores. Reducing fees would greatly benefit our industry margins.

- The spotlight on high fees charged by Visa and Mastercard in the US is becoming more noticeable due to their comparatively lower fees in other (Average EU Interchange: 0.30%; Average U.S. Interchange: 2.00%)

The Bad:

- The CCCA only impacts Visa and Mastercard and the issuing banks with over $100 Billion in assets. (There are only 32 financial institutions that fall under this category. Ex: Chase, Wells Fargo, BofA, etc).

- This excludes Visa and Mastercard issued from smaller banks, American Express, and Discover.

The Ugly & Unclear

- “Merchant Choice”: The bill has been designed in a way that gives Merchants the freedom to choose between alternative networks. Bigger Merchants like Walmart already have the necessary technology to direct their PIN debit transactions to the network of their choice. However, small business owners don’t have the means to do so and are likely restricted to a single network.

- Alternative Networks: I recently had a phone call with a representative from Shazam, one of the networks that appears on the back of some debit cards. They are one of the secure “alternative” During our discussion, they confirmed that it would be challenging for routing networks to be established for small businesses. As a result, small businesses would likely have to rely on their payment processors to facilitate the routing process. This confirms that realistically only large merchants would have the option to choose the alternative network.

- Expensive Upgrades: The petroleum industry has been slow to adopt new payment technologies, having been the last to adopt EMV. Upgrading convenience stores for every technological improvement can be costly. The average mom-and-pop convenience store spent between $10,000 and $20,000 to upgrade its POS and pay-at-pump 99% of these stores still lack end-to-end encryption at the pump. Routing Visa and Mastercard transactions would be a significant software and potentially hardware upgrade. This could hurt merchants who have yet to recover from the previous upgrade expenses.

Do we need card fees reform to lower fees? Absolutely. Will this bill pass? Likely not this round.

Email me today:

KC Cook

Founder & President

KC COOK | PIX

p: 919.215.7908

e: kc@trypix.io

More information: