The Lowdown on Credit Card Fees for Fuel Brands

Alright, folks, gather ’round the virtual gas pump because we’re about to spill the beans on those sneaky credit card fees that hit you where it hurts – your margins!

THE FUEL BRAND’S MONEY-MAKING MAGIC:

Fuel Brands make some of their moolah from transactions and sales volume. No surprises there. And your average transaction amount? Well, that’s the secret sauce that affects how much they take from your pie. Examples in Plain English:

- Take Major Fuel Brand “A.” They’ve set a premium on Visa transactions. They charge 2.12% plus 22 cents for Visa transactions. If a customer drops a hundred bucks at their pump, you’re handing over $2.34. But wait, not all of that goes into their piggy bank. Visa and the bank get a piece (around $1.40), leaving Major Fuel Brand “A” with around $0.90, a margin of about 0.90%. Ka-ching!

- Now, Major Fuel Brand “B” plays a different game. Their premium is on Debit transactions. For Debit, they charge 1.30% plus 14 cents. If you grab $20 worth of snacks in their store, they snag 40 cents. The bank gets its share too (around $0.23), leaving Major Fuel Brand “B” with $0.17, a margin of around 0.80%.

THE REBEL CARD PROCESSORS:

But, hold on to your gas cap! Unbranded Card Processors are like the cool kids in town. They pass through the bank fees and toss in a smidge of percentage and a few pennies for ALL CARD transactions. For that $20 debit card purchase, they would charge 30 cents. After the bank takes its share, it leaves the Unbranded Card Processor with around $0.06, a margin of 0.30%.

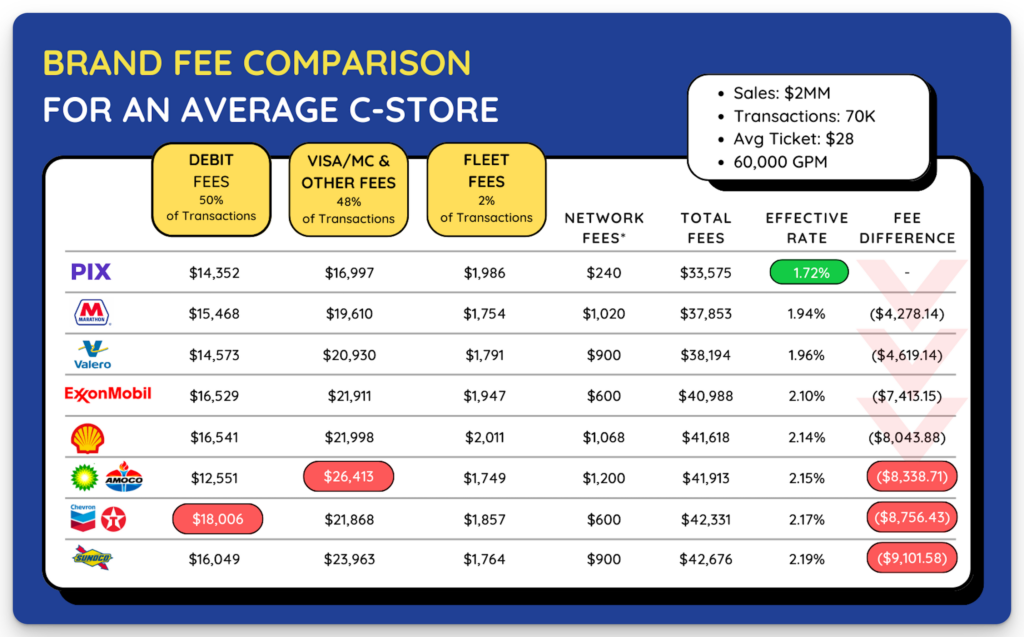

SEE THE CHART – NOT ALL BRANDS ARE EQUAL:

- Brands aren’t all cut from the same gasoline-soaked cloth. Some brands cut deals for specific cards.

- Is this chart accurate for every gas station? NO! Your store’s average ticket and card mix will impact which brand is the best value.

WHAT CAN YOU DO ABOUT IT?

- We can help you evaluate your card fees as one crucial piece of your next brand choice.

- Thinking of switching brands? Don’t skip the fine print on card fees. If your gas station pumps serious volume, the difference between brands could be $150,000 during a brand contract.

IF YOU ARE UNBRANDED, SCHOOL YOURSELF BEFORE CHOOSING YOUR PROCESSOR:

- Never say yes to a “Blended Rate” or “Flat Rate” agreement. That 1.90% plus 15 cents might seem like a steal, but some card fees are as low as 0.05%, a serious margin you give the processor.

- Check your current processor’s fees using this golden rule: if your average ticket’s around 25 bucks, your total fees should be under 2%.

SEEING THE BIG PICTURE:

In a world filled with Fortune 500 layoffs and soaring interest rates, customers care more about the sign that says “Cheap Gas” than the color of your canopy. So, think twice about that branded signing bonus—it might cost you more than you think.

If you’re on the hunt for a new brand and want a breakdown of card fees that doesn’t make your head spin, give us a shout. We’ll be your trusty navigators in this wild sea of credit card fees.

Happy retailing!

KC Cook

Founder & President

KC COOK | PIX

p: 919.215.7908

More information: