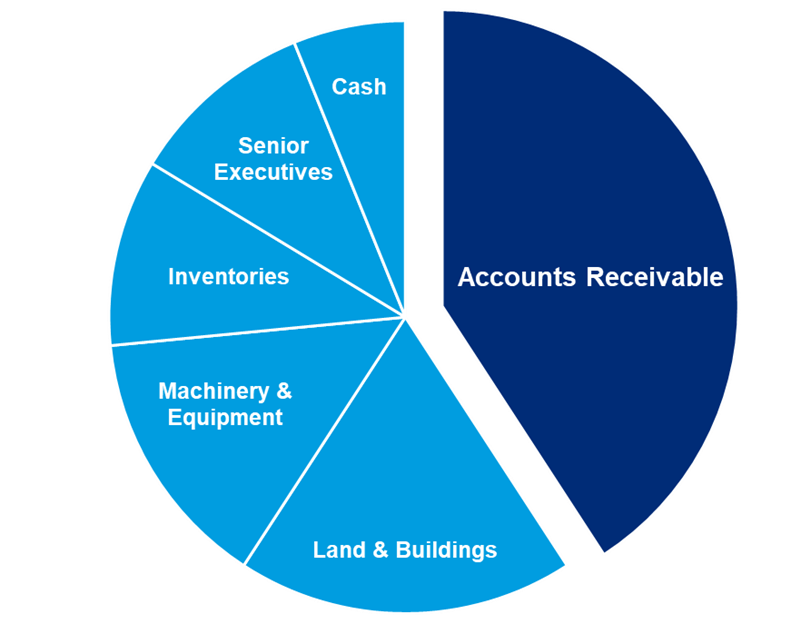

Insured vs. Uninsured Assets

For many companies, the chart above shows a typical commercial balance sheet. Companies don’t think twice when insuring their buildings, equipment, and inventories; however, they often fail to insure their accounts receivables when they can make up roughly 40% of their assets. I would argue that you have a better chance of filing a claim on a non-payment of a receivable than you do on the fire insurance of your building. So why aren’t more companies insuring their receivables?

There are many reasons why companies don’t insure their A/R. Here are four of the most common I’ve seen over the last 16 years I’ve been in the business.

- They don’t know they can.

Credit insurance has been used for over 100 years and many of the largest companies in the world use it. Surprisingly, many use it for ways other than loss prevention as trade credit has so many different applications.

- They may think they have to insure all of their A/R.

While many companies choose to insure their whole portfolio, you don’t have to. You can carve out a group, choose a segment, pick your largest exposures, project based, or bank required accounts to free up capital.

- They think their customers are solid and always pay.

All customers pay…until they don’t. In 2024, commercial bankruptcies are up 16% from 2023 and rising. Credit insurance covers slow pays as well.

- They think it is too expensive, given the thin margins in the fuel business.

Compared to other lines of insurance, trade credit is one of the cheapest. We are seeing rates hovering around .003 per gallon. A $30,000 load of fuel costs around $25. Imagine how many new loads of fuel you’d have to sell to make up for a single loss of $30,000.

CREDIT INSURANCE.

Credit insurance is a cost-effective sales tool that allows you to insure your receivables so you can safely sell more to your existing customers, go after new customers that may have been a credit risk in the past, and expand into new markets that you originally perceived to be too risky. Credit insurance offers a cost-effective solution for safe and profitable growth:

- Grow sales safely, domestically and abroad, to new and existing customers

- Protect your business from risk of non-payments

- Make better and faster credit decisions

- Ease tensions between sales and credit

- Avoid personal guarantees

- Borrow better from the bank by eliminating concentrations and obtain higher advances with lower rates

- Eliminate letters of credit and replace them with a tax-deductible insurance provision

- Gain leverage to collect from your customers

Contact me below and let’s discuss your options.

Cory Watson

Vice President, Trade Credit and Business Insurance

T +1 817-600-1916

M +1 817-715-5678

1600 West 7th Street Suite 300, Fort Worth, TX 76102