Health Plan Fiduciary Responsibilities Are Here. Are You Prepared?

3 Things to Know & 3 Best Practices

The landscape of health plan fiduciary responsibility has changed. Since the passing of the Consolidated Appropriations Act of 2021 (CAA), more and more attention has and is being brought to health plan stewardship…are you prepared?

In this article we will introduce you to three things to know and three best practices to implement, if you haven’t done so already.

3 Things to Know:

1. What is the Consolidated Appropriations Act of 2021 (CAA)? The CAA is a 2,100+ page bill, covering several ‘appropriations’ or components, with one specific ~30 page section for Employer Sponsored Health Plans [See Division BB, Title II, Sections 201-204].

Meaning, health plan sponsors now have four new obligations to adhere and attest to.

- Removal of Gag Clauses…aka removing contract language restricting plan sponsors from accessing their OWN DATA.

- Compensation Disclosures…aka compensation transparency, both direct and indirect, from any vendor/partner involved with the health plan.

- Non-Quantitative Treatment Limitations (NTQL) Testing…aka “strengthening parity in mental health and substance use disorder benefits” [direct from CAA bill].

- Prescription Drug Data Collection (RxDC)…aka extensive prescription drug reporting aimed to bring transparency to Rx costs.

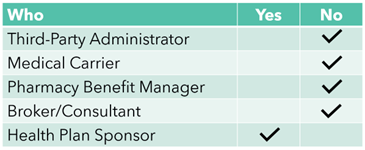

2. Who is the fiduciary? You, the health plan sponsor AND individuals responsible for decision making.

From the U.S. Department of Labor, “The primary responsibility of fiduciaries is to run the plan solely in the interest of participants and beneficiaries and for the exclusive purpose of providing benefits and paying plan expenses.” For extended definition: https://www.dol.gov/general/topic/health-plans/fiduciaryresp.

3. Lawsuits have started and more are coming.

- Kraft Heinz (June 2023) – Employer against Aetna, their third-party administrator (TPA) related to access to data. Full story here: https://www.beckerspayer.com/payer/kraft-heinz-drops-claims-data-lawsuit-against-aetna.html.

- Johnson & Johnson (February 2024) – Employee against their employer related to cost of prescription drugs. Full story here: https://www.reuters.com/legal/litigation/jj-faces-class-action-over-employees-prescription-drug-costs-2024-02-05/.

- Mayo Clinic/Medica (April 2024) – Employee against their employer/TPA related “deceptive, misleading, arbitrary pricing methods.” Full story here: https://minnesotareformer.com/2024/04/03/mayo-clinic-employee-files-class-action-lawsuit-over-high-health-care-costs/.

3 Best Practices:

The aim here is to substantiate your individual and health plan’s “Good Faith Effort” towards compliance with CAA and upholding fiduciary responsibilities.

- Leverage Subject Matter Experts (SME)

- ERISA attorneys to review Administrative Services Agreements (ASA) and Summary of Plan Designs (SPD).

- Pharmacy Benefit Consultants to lead RFPs, review contracts, and audit pharmacy benefit managers (PBMs).

- Establish a process to measure and evaluate partners

- Periodic RFPs; specifically for pharmacy benefits, ancillary benefits, and fixed costs.

- Periodic Carrier/Network Analysis; to determine network optimization…aka is this the right carrier for our health plan.

- Set-up a Data Warehouse; to own, deposit, and analyze your own data.

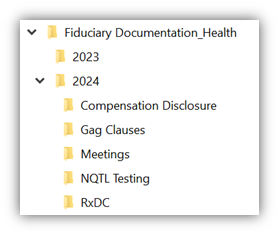

- Document, document, document

You are already doing a lot of this work…having benefit meetings, discussing strategy. Put it on paper and stash it away. You can create a specific folder just for your health plan fiduciary documentation. See example folder set-up below:

Conclusion: There is a silver lining. While the added requirements, work, and attention will be a clunky transition, long-term this shift should lead to positive market impacts for employers and employees by:

- Increasing transparency in pharmacy costs and vendor compensation

- Opening doors to access more data and information

- Strengthening benefits regarding mental health and substance use

For more details or questions please reach out to Brian Uhlig or Ty Franklin. See contact details below.