Monitoring the Insurance Market

Fall 2022

Holmes Murphy continuously monitors the insurance market to keep a pulse of rates, capacity, underwriting appetite changes, financial stability of insurance carriers, and service capabilities to better prepare customers for changes that may impact their policies.

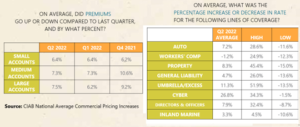

Q2 2022 was the 19th consecutive quarter of overall rate increases. The overall average rate increase was 7.1% compared to 6.6% from Q1 2022. All lines of coverage continue to increase in rate except Workers’ Compensation which continued to decrease slightly at 1.2%. Small Accounts (premium less than $250k) have stayed steady from Q1 to Q2 with the same increase of 6.4%. Medium Accounts (premium between $250k and $1M) is also steady at 7.3%. Large Accounts (premium over $1M) saw a slight increase from Q1 from 6.2% to 7.5%.

Recent inflationary trends continue to impact the market, with commercial auto and commercial property lines of business being affected the most. Property in natural catastrophe-prone areas continue to be difficult to secure robust coverage and competitive pricing, especially in areas vulnerable to wildfires, which often leads to increased deductibles and limited underwriting capacity.

Reference the “Key Takeaways” section of this article for additional information and recommendations to best manage and respond to these changes.

Benchmarking – Rate Comparison Data

The following charts compare the industry market results* in Q2 2022 (April 1 – June 30) compared to Q1 2022 (January 1 – March 31).

Source: CIAB National Average Commercial Pricing Increases

Benchmarking – Historical Premium & Rate Changes

Key Takeaways

There are a lot of dynamic forces in the market today. Awareness of those items and understanding of how it may impact your insurance program will prepare you for the various buying decisions.

Cyber: According to a recent report by Sophos, the cyber security firm, 66% of midsize organizations worldwide were targets of a ransomware attack last year compared with 37% in 2020 (Insurance Journal Sept 22). Policies continue to be hit with increases averaging over 25%. Insurance carriers are continuing to tighten underwriting capacity and guidelines, including the implementation of security protocols, such as multi-factor authentication.

Auto: There are several factors contributing to the 7.2% average increase in Q2 2022 for auto. They include auto body repair costs (part shortages, rising labor rates and expense vehicle components), social inflation (increasing trend to hire attorney immediately and higher compensation for damages expected) and nuclear verdicts (auto accidents make up many these verdicts).

Weather: According to Forbes Advisor, experts are predicting an “above average” hurricane season, which is officially June 1st through November 30th, in 2022.

Take a look at the full CIAB Commercial Property/Casualty Market Index Q2 2022 for a deeper dive into the marketplace trends.

*Holmes Murphy is an active member of The Council of Insurance Agents & Brokers’ (CIAB). CIAB, established in 1913 is a high-touch member-based trade association for over 200 of the world’s top commercial insurance and employee benefits brokerages. As an active member, Holmes Murphy utilizes the resources to stay in tune with insurance market conditions in our local community and across the country. Any advice, comments, direction, statements, or suggestions contained herein is provided for your information only and is not intended as, nor does it constitute, legal advice. Neither Holmes Murphy, or any of its subsidiaries or affiliates, represent or warrant, express or implied, that such statements are accurate or complete. Nothing contained herein shall be construed as or constitute a legal opinion. You have the right to, and should, seek the advice of legal counsel at your own expense.

Gerald Johnson

gjohnson@holmesmurphy.com

(515) 223-6826