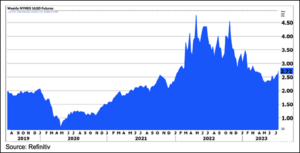

Diesel Price Volatility – It’s a Feature, not a Bug

Diesel prices have swung dramatically because of

Pandemic Inflation

War Rising Rates

These massive price swings have made the job of the fuel buyer extraordinarily challenging. POWERHOUSE helps jobbers, marketers and end-users manage fuel price volatility.

Contact us to learn how you can answer one of the most critical questions your customers have — “Am I buying at the right time?”

POWERHOUSE helps companies develop and implement hedging programs. The purpose of price risk management is not to predict an unknowable future but to take proactive steps to protect your company’s bottom line.

Every business is different. We’d appreciate the opportunity to learn more about yours.

Contact us today to see how we can help your company.

David Thompson, CMT Executive Vice President

(202) 333-5380

ICE IM: dthompson17

Futures Disclaimer

Futures trading involves significant risk and is not suitable for everyone. Transactions in securities futures, commodity and index futures and options on futures markets carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit.

Powerhouse Trading Disclaimer

Powerhouse is a branch office of Coquest Incorporated, a registered introducing broker. Coquest Incorporated, an affiliate of Coquest, or a company with common ownership with Coquest may act as a principal to a block trade with [Client]. When acting as principal, Coquest will be a counterparty to the block trade and (i) will not be acting as Client’s broker or agent and (ii) is not under any obligation to act in [Client]’s best interest.