To Bundle or Not-to-Bundle? That is the Question.

How Un-bundling Your Health Plan May Lead to Lower Costs & Better Care

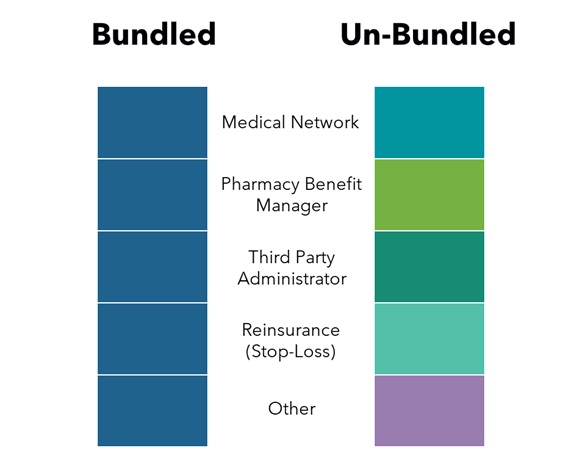

Any health plan is made up of the same fundamental components:

- Medical Network – where members go to receive healthcare: doctors, hospitals, providers, etc.

- Pharmacy Benefit Manager (PBM) – fulfills prescription drug coverage, contracts with pharmacy ecosystem.

- Administrator – responsible for processing claims incurred by members per company plan designs and contracts.

- Reinsurance – protects health plans against catastrophic risk on both individual and aggregate claims basis.

- Other – covers remaining miscellaneous items that round out a health plan: i.e., point solutions, nurse navigator, etc.

We start here, because it’s important to know what health plans are made of. From there we can then navigate and evaluate what different solutions are available.

From a high-level perspective, there are primarily two different ways to construct health plans.

- Bundled Arrangement – The same parent company owns and operates all areas of the health plan.

- Un-Bundled Arrangement – Each component of the health plan can be individually shopped and acquired.

Bundled arrangements are most common in today’s marketplace (think Aetna, Blue Cross Blue Shield, Cigna, and UnitedHealthcare products). In this setting, the health plan has an Aetna medical network, Aetna PBM, Aetna administrator, Aetna reinsurance, and Aetna ‘other’ components. This is also known as “Vertical Integration.”

Alternatively, an un-bundled health plan could have an Aetna medical network, transparent, pass-through PBM, independent third-party administrator, outside reinsurance partner, and a variety of ‘other’ solutions that are incorporated in the health plan. While slightly more complex, with multiple vendors at play, this environment resembles free market capitalism, providing more transparency into the cost, negotiation leverage, and purchasing power.

Example of cost-saving opportunity: In a bundled arrangement, if you are dissatisfied with a specific component, say pharmacy benefit costs, you are prohibited from going and finding an alternative vendor (it’s a take it or leave it dynamic). Conversely, in an un-bundled arrangement, if you are dissatisfied with the pharmacy costs, you can go to market and find multiple other options.

In conclusion, exploring an un-bundled health plan solution, whether fully-insured, level-funded, or self-insured, could be a fruitful endeavor…and this is just the beginning of leveraging and maximizing the full potential of your health plan!

Note: Not all employer health plans may qualify or be a good fit for an un-bundled health plan solution, nor are they guaranteed renewable in the fully-insured/level-funded marketplace. Please discuss with an experienced consultant to navigate this opportunity.